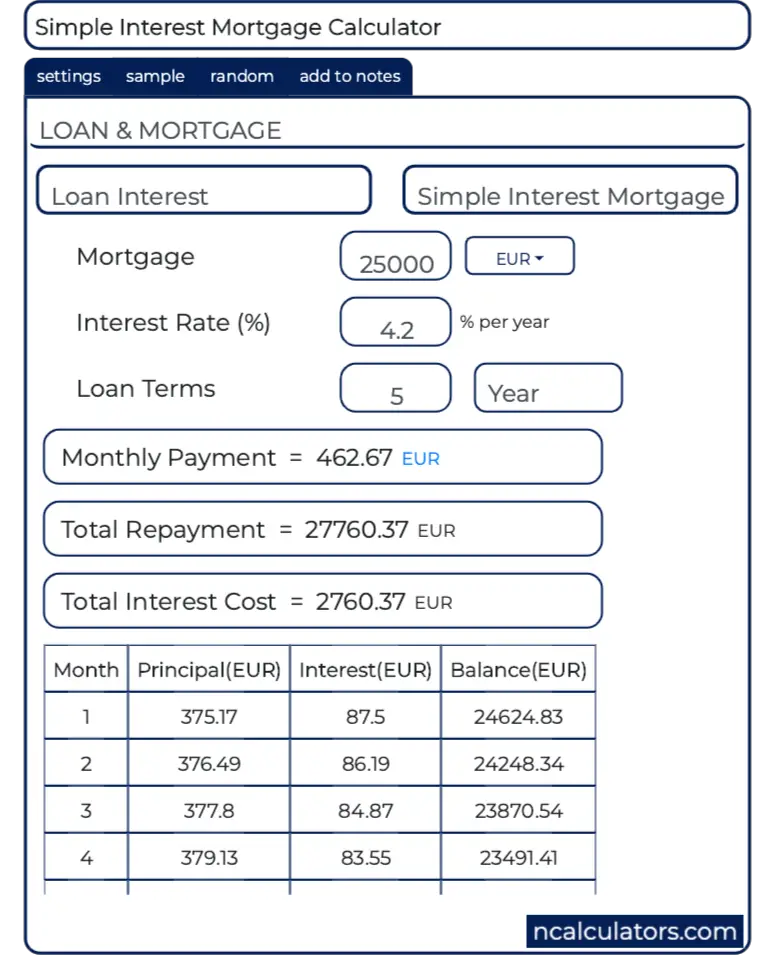

How long would you like to repay your loan?Ī 5-year loan isn’t the same as a 15-year loan. By reducing the principal, the interest charges will begin to decrease each month. Payments are generally allocated first to cover the accrued interest charges, and then shifted to paying off your principal. Determining the amount of principal you can comfortably borrow should entail taking the time to analyze your entire financial situation as well as advanced planning for any unforeseen expenses. While determining the principal is simple, deciding the amount you can realistically afford to pay back can be a little trickier. To put it simply, the principal of a loan is the raw dollar amount you are borrowing. Some loans will require you to pay closing or finance costs, which aren’t technically included in your interest rate. The raw interest cost is essentially an interest ‘rate’, whereas the APR includes additional fees. It includes additional costs beyond the interest charges. The annual percentage rate (APR) will tell you what percentage in total over the principal you pay per year. Each payment includes a certain amount of both principal and interest. With installment loans, interest is accounted for in your monthly payment. While paying interest to borrow money is necessary, the underlying costs of interest aren’t always obvious.įor example, imagine you are paying off an installment loan.

The first part of the payment is allocated towards the actual balance, or, “principal.” The second portion is allocated to the fees for service or the “interest.” Payments made by the borrower are comprised of two parts. Think of interest as a particular service fee paid by borrowers to cover costs associated with loans. To help better explain what our simple loan calculator does and how it establishes monthly payments, we break the payments down into two different crucial components – “principal” and “interest.” Loan interestĭo you ever wonder how lenders are able to offer loans? The answer is by charging interest and through other fees. Loan qualification is typically determined by both the borrower’s income and their perceived ability to repay. Loans are an essential tool to help borrowers take large or small financial actions, such as catching up on bills, making car payments, or creating a little bit of financial wiggle room.

0 kommentar(er)

0 kommentar(er)